The insurance industry has evolved significantly in recent years. Nowadays, clients of insurance companies don’t want to wait on hold, fill out endless forms, or repeat their story five times to different specialists. You might ask me, “So, what are their expectations instead?” Well, put yourself in their shoes - of course, they want instant answers, a smooth process of claims, and support that gets everything right from the first time without the need to repeat it over again. That’s where Generative AI and insurance form a great combo.

If you’ve clicked the link to read this article, you’re definitely curious about what these chatbots actually do, how they fit into your business, and why everyone’s obsessed about them. First of all, they are not just an option anymore. A recent study by EY discovered that 42% of insurers are already investing in Generative AI solutions. At the same time, 57% of them have elaborated strategies on how to integrate them in the near future. Where do you belong?

Right place, right time - I’ll walk you through the concept of generative AI in insurance, and you’ll learn more about its use cases, the benefits it brings, and best practices to implement to reshape your business inside out.

Generative AI Chatbot: What Is It?

I hope you’re not expecting to hear that generative AI for insurance works as a typical FAQ responder. Let’s break it down.

GenAI goes beyond just spitting out predefined answers. These chatbots are much smarter - they understand your customer, get the context, understand multiple languages, and even feel and interpret the intent (revolutionary ones even recognize emotions). I won’t exaggerate if I say that they can chat in a natural, humanized manner, give personalized answers, and easily adapt on the go.

The best way to measure the efficiency of some solutions is to ask the users. Here’s the kicker - according to Sprout.AI's report, 47% of customers in the UK and 55% in the US are in favor of Gen AI tools. And when we look at the Statista report, we find out that 44% of clients prefer generative AI in insurance for claims and 43% for coverage applications. Sounds like most people are more than ready to adopt new technologies, and you should rush to launch one as well.

Gen AI chatbots vs. rule-based and traditional chatbots: How do they differ?

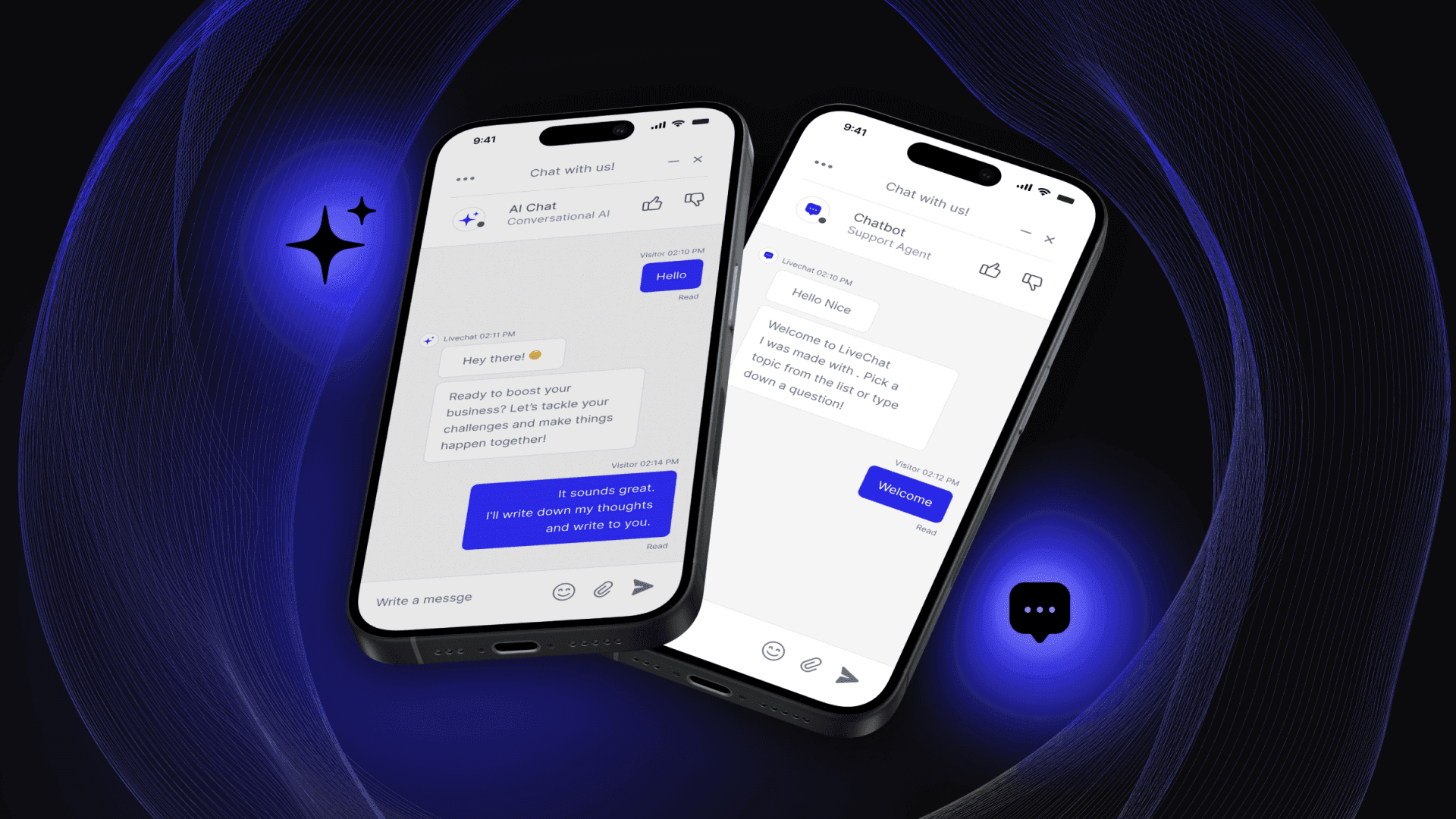

Earlier, I mentioned that generative solutions stay ahead of traditional ones. But what’s the difference? Simply put, when using traditional chatbots, it’s like working with phone menus. It may give options like “press 1 for claims”, “type YES to continue”, etc. There’s a rigid algorithm they follow. Moreover, they may just freeze if asked something unexpected. Rule-based chatbots, on the other hand, work like instructors, but they can’t hold conversations.

And what about insurance chatbot examples? Well, that’s a whole different story, to be honest. They have access to massive data sets, language models, and information so they can generate answers themselves. And it’s not just about picking answers from a fixed list. No, they create those replies depending on the input. It feels almost like communicating with a human rep who gets your mood, tone, intent, and sees the situation clearly. Of course, there are cases that still require human agents. However, you can significantly save your human resources for more valuable tasks.

Generative AI and main technologies behind it (LLMs, NLP, ML)

So, how does this magic happen? The main formula for success includes an experienced artificial intelligence software team, a rigorous strategy, and key technologies. Below in the table, you can get acquainted with the main tech stack that makes Gen AI bots work to their fullest.

| Technology | What it does |

| Large Language Models (LLMs) | Understands grammar, semantics, and context, and creates natural conversations (like ChatGPT) |

| Natural Language Processing (NLP) | Interprets questions, gets emotions, and figures out of something is confusing |

| Machine Learning (ML) | Helps bots get smarter over time and learn from conversations and interactions |

With the skilled practices of software companies and the knowledge of their employees, the combination of these technologies presents your clients with intelligent customer service and a chatbot for insurance that actually helps.

Exploring Use Cases of Generative AI Chatbots in Insurance

Now that you know what it is and how it works, let me provide you with insurance chatbot examples and what these bots can really do.

Automated claims processing and assistance

Gen AI chatbots can literally walk customers through the claims journey. Collecting incident details, requesting documents, and even giving updates. All is done without anyone waiting on hold, at any time of the day. And the bot won’t even yawn.

Personalized policy recommendations

Gen AI bot can ask the right questions to give tailored suggestions based on the user’s profile, risk, location, and query. No awkward sales pitches. Just smart and detailed policy advisors.

24/7 customer support for policyholders

Bots don’t need sleep, unlike humans. The insurance industry requires customer service to be all-in at any time of the day and week. People may have any policy questions, forget their passwords, or want to download their insurance card - the chatbot is there.

Quote generation and onboarding

Forms can be endless and frustrating. Bots, on the other hand, can collect data through conversation. This way, people can get a quote for home insurance in just one minute. Moreover, the genAI chatbot can guide and set up onboarding for users.

Fraud detection and anomaly reporting

Automation is amazing, as your gen AI chatbot can detect and flag any suspicious claims. It also finds inconsistencies in user responses effortlessly. Imagine this: someone changes a story mid-conversation, the system detects an anomaly, and alerts a human rep to step in.

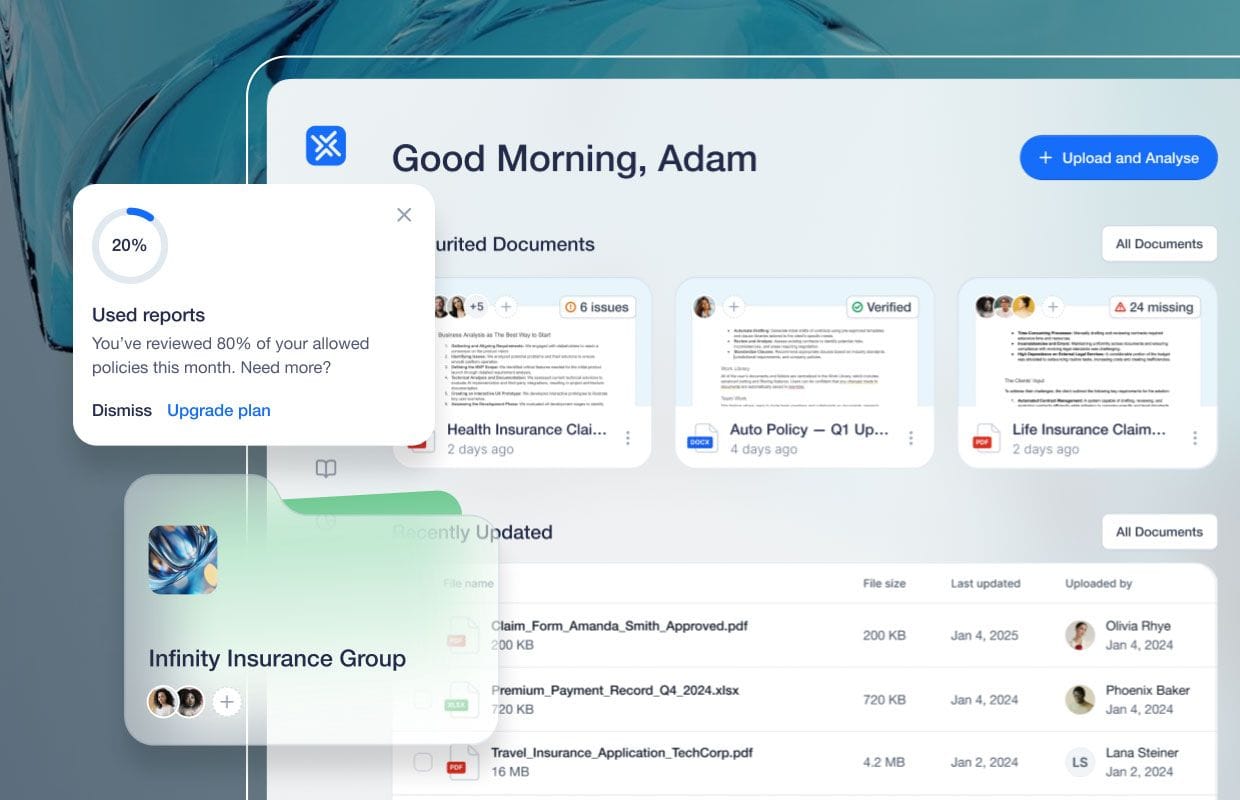

Internal support for agents and brokers

This I’ve left for dessert — not only do customers benefit, but also your teams. Agents and brokers can get policy details, claims and case statuses, documentation templates, clients’ information, and more. No need to dig through piles of paper — just ask the AI insurance assistant.

Below in the table, I’ve prepared some most popular real-world uses of AI in insurance.

| Solution | Details |

| Helvetia “Clara” | GPT-4-powered; handles queries about insurance and pensions; supports multiple languages; works 24/7. |

| Allianz “AI-Powered Assistant” | Works across channels; handles end-to-end interactions; supports multiple languages; helps users with risk analysis, underwriting, and claims management. |

| SWICA “IQ Chatbot” | Serves as a virtual assistant; handles FAQs and account tasks; chat-based service without redirects; multilingual support. |

Defining the Benefits of Generative AI Chatbots in Insurance

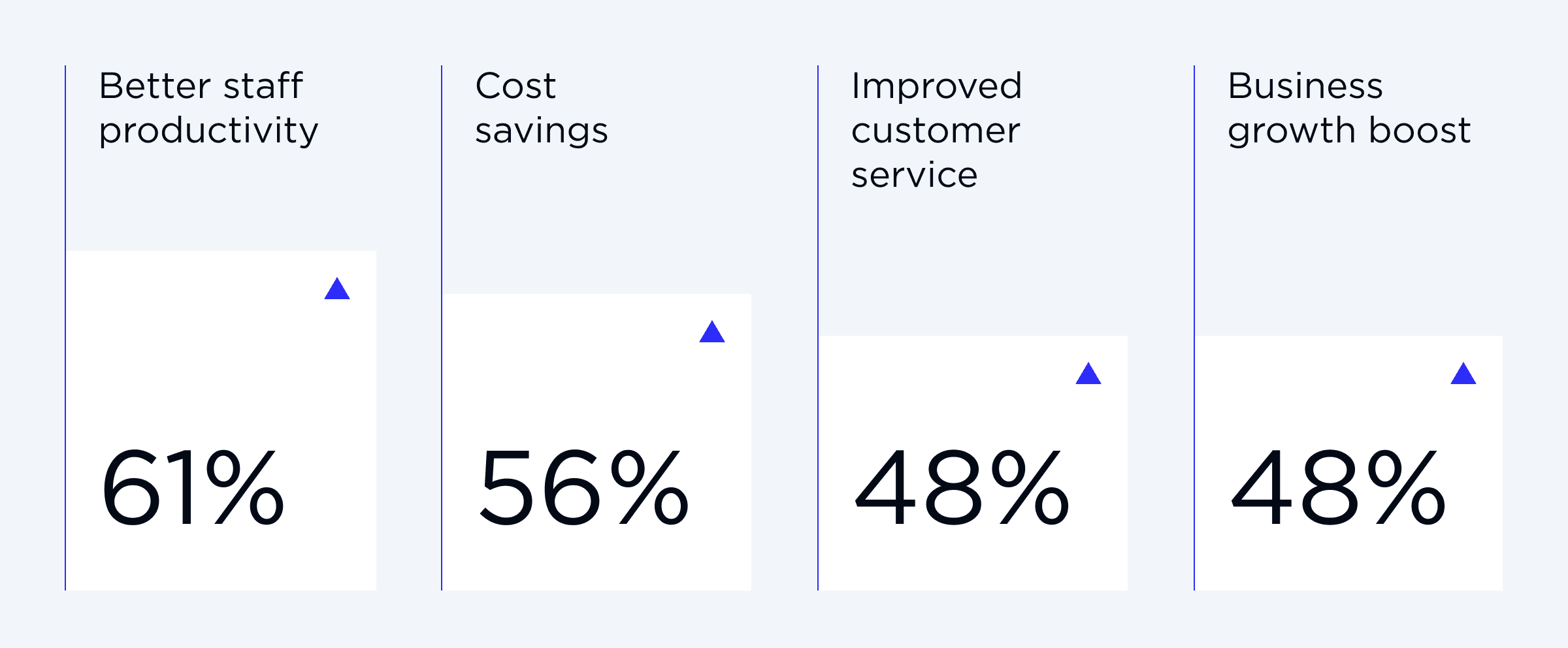

Now, we’ve reached probably the most important part - the benefits of generative AI for insurance. And here’s the real value - there are many of them. I’ve selected the most important ones. Before we explore, let me provide you with the stats by Sprout.ai that have discovered that the implementation of gen AI solutions has improved staff efficiency and productivity (61%), helped to save costs (56%), enhanced customer service (48%), and boosted growth (48%).

Reducing operational costs

When you hear that you need to hire and train customer support teams for every region and product, the first thought that springs to your mind is “expensive”. However, when involving generative AI in the insurance industry, your chatbot can handle most queries and frees up space, time, and money for high-value tasks. Result - a lot of saved costs.

Improving customer experience and engagement

When a customer contacts an insurance company through a chatbot and doesn’t need to repeat themselves three or more times - that’s a good service. And when your company’s bot can understand their language, get the problem, and recognize the tone - that’s a top-notch service. Result - stronger trust and better retention rates.

Speeding up turnaround for claims and queries

No more lines, holds, “wait a few minutes”, “are you still here”, and the like notifications. All claims and queries are processed fast and efficiently, as AI technology allows for pre-collecting all the needed information. You should also forget about policy questions that take a day or more. Result - your clients get answers in minutes, if not seconds.

Following consistent communication across channels

Your customers may contact you via website chat, WhatsApp, your app, Messenger, or any other channel of communication. And you know what? The GenAI chatbot for insurance keeps all the messages aligned! Customers are no longer frustrated by switching between channels. Result - your brand has one consistent voice.

Providing scalability during peak hours

How does your team manage peak periods? Even when everything’s kept in check, it can be overwhelming. Well, with gen AI bots, you shouldn’t worry as they handle it automatically. Storm season? Market collapse? Cyberattack hustle? Automated and AI-powered helpers take this burden off your shoulders. Result - no long wait times or backlogs.

Fill in the form to revolutionize your customer support.

CONTACT USAre There Any Challenges and Considerations to Address?

So far, everything sounds perfect, right? I’d love to say so, but not quite. There are a few things to keep in mind. Let’s break it down.

Regulatory compliance and data privacy

Use of AI in insurance comes with super rigorous compliance. The insurance industry breathes regulation, so chatbots must follow all standards (GDPR, HIPAA, and other laws). One breach and the game's over. No wonder why 49% of insurance CEOs still consider it a risk.

Human maintenance and escalation paths

Everyone can make a mistake. And even the best bots get stumped. Keep your escalation paths seamless. Make sure your customers are redirected to humans without repeating their whole story (and it’s not only about the topic but also context).

Accuracy and reliability in complex queries

As of today, some complex scenarios involving emotional distress, medical reports, and legal papers may confuse AI chatbots. To avoid any misunderstanding, make sure humans are in the loop to handle such cases.

Customer trust and transparency

Even when your bot sounds like a human, always let your customer know whether they are talking to a bot or not. Some people choose to be redirected to human agents immediately, as they still worry about their data. Offer opt-outs, be upfront, and let users be in control.

Implementing generative AI in insurance might seem daunting at first, but staying still is a bigger risk. With the right tech partner, you can start small, ensure full compliance, and gradually scale your solution. Innovation doesn’t have to be all-or-nothing — it just has to start.AI Chatbots in Insurance: Best Practices for Deployment

Keep in mind that the deployment approach and best practices for generative AI for insurance always come with a dedicated software partner. But let me break it down for you on how to get started in a smart way, using an AI-powered chatbot for insurance to streamline customer interactions and internal workflows.

High-impact use cases first

Never try to automate everything at once. Choose those tasks that eat up time (claims and policy questions, for example). You can always scale up later.

Prioritize data quality and security

It’s a must to have organized, clean, and clear data. The better input you provide, the smarter your bot will be. Thorough encryption and access controls are non-negotiable.

Keep humans in the loop with AI

The gold standard to follow is hybrid models. Complex and sensitive cases for humans, routine ones for AI. Don’t replace, but enhance.

Always train and monitor your model

Customers need change, language may evolve, and technologies upgrade. Never skip updates, conduct feedback loops, and A/B testing.

Looking Ahead: Future Trends of AI Chatbots in Insurance

Even though AI technology impresses more and more with every day, I understand one truth - we’re just scratching the surface. It has more opportunities to unlock in the future. So let’s discover what may come first.

Integration with voice, face, and multilingual capabilities

Considering Gen Z is sending voice messages left and right, we should expect voice bots to take over. They can become global support heroes with face recognition, voice options, and real-time language translation.

Predictive analytics for underwriting and risk management

Risk management and underwriting are crucial for any insurance company. Just imagine that in the future your chatbot can also predict any risk and detect fraud. Generative AI in insurance will switch from active to proactive.

Profound personalization through generative AI

I think you’ve noticed the specifics of ChatGPT, and you will understand what I’ll say next. Tomorrow’s chatbots will remember not only your name but also your preferences, previous claims, and life events. Personalized, always-on, and omnichannel.

Wrapping Up

Long story short, I can’t help mentioning that insurance does need a glow-up. And honestly, that’s exactly what Gen AI bots do. Streamlining processes, improving support, cutting down costs, and making customers satisfied. And I can keep repeating that it’s just magic. But let’s be real - it requires a proper setup. And that’s exactly what OTAKOYI can do for you.

When you partner with a reliable software company and have a strong data and human backup, you can shine in your industry even when the competition is fierce. Choose a partner (like OTAKOYI, hint) and feel the difference between a frustrating bot and a brilliant one.