I believe everyone remembers their first interactions with a digital banking app or other tools, right? Do you remember that feeling? I bet it felt like technology was transforming your banking experience, removing long lines at the bank. Transferring money, checking the balance, applying for a small loan, etc. It started with simple functions but made a huge difference. Fast forward to today, and we’re not just using online banking or other financial apps. We’re interacting with AI assistants regarding fraud alerts, investments, and retirement planning.

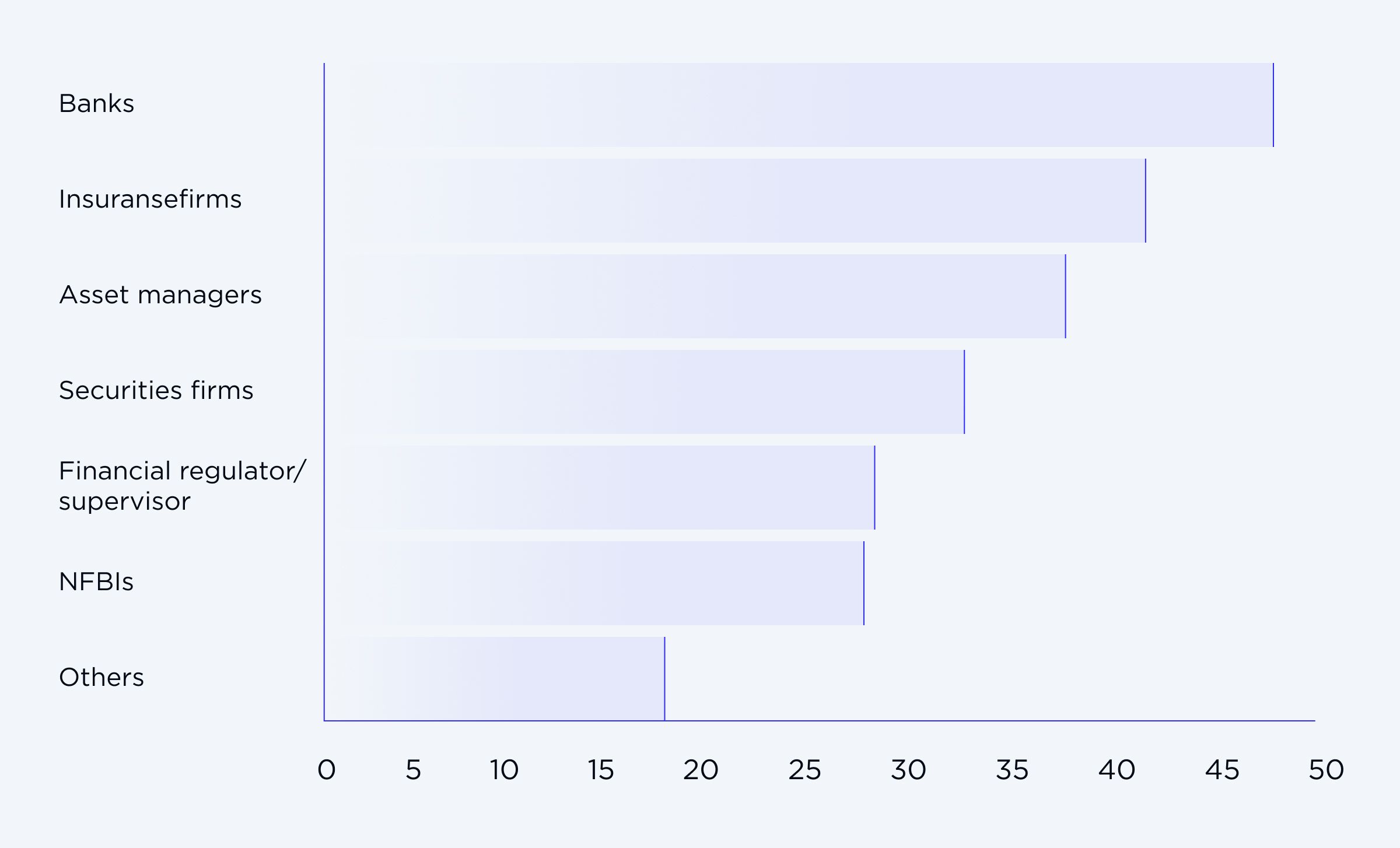

Believe it or not, there are many companies in the financial industry that are experimenting with or implementing AI financial assistants. The OECD conducted an analysis on that. Let’s explore it in the table below.

As you can see, implementing AI is a significant leap in the market. In their recent article, IBM has cited their IBM Institute for Business Value research stating that 68% of executives report experimental use of AI automation with their digital assistants. It is done with the expectation of establishing independent AI agents in finance operations (mainly for self-service).

You may start wondering how it is possible to automate such a tightly regulated industry. Actually, this industry is the fastest to adopt AI in personal finance. How? Considering the fact that the stakes are high and the industry is super competitive, banks, insurance companies, financial regulators, investment firms, and other financial institutions need both efficiency and accuracy. That’s the explanation - AI assistants promise exactly that. As a result, finance firms receive other perks, like smoother customer experience, faster processes, smarter decisions, etc. However, I should also say that there’s a catch. Which one? Well, it’s compliance. Even though innovation keeps moving forward, regulators keep reminding us about security. So, the most important part when adopting AI is following transparency, ethics, and security requirements. How do you balance all of that? Let’s break it down in this article.

Discovering The Role of AI Assistants in Finance

As I’ve already mentioned, AI personal financial assistants are closely embedded in our everyday financial processes. There are many ways they form the backbone of modern-day financial services, from handling customer requests to a system scanning for any fraudulent activities. For a better understanding of the role they play nowadays, I’ve decided to break them down into groups of key areas. Let’s explore.

Automating routine tasks

How often do you wake up being excited about the paperwork waiting for you? Exactly! Fortunately, AI financial assistants just thrive in this area. How can they be helpful?

- Customer service chatbots

Customers improve their experience without waiting on hold, as they can interact with chatbots that give instant replies regarding balances, card issues, or account settings. In case of more complex tasks, they are seamlessly transferred to relevant human agents. - Data entry and reconciliation

A long time ago, it would take hours to match transactions or balancing accounts. Employees at different financial institutions basically wasted that precious time, which they can now use for more strategic work while AI tools automate everything. - Loan and credit processing

We remember when the credit application process was full of waiting and red tape. Nowadays, online banking AI assistants can easily review applications, pull relevant financial history, and even make initial recommendations, reducing approval times.

It’s important to note that AI solutions don't just save your employees’ time. They also cut down the costs, enhance accuracy, and provide for scaling without hiring an entire new department.

Enhancing decision-making

Making the right decision is essential, I’d even say the lifeblood, of finance. However, there’s a catch. There are more and more customers who make millions of transactions worldwide. It’s just physically impossible for people to process so many queries in real time. Good news! AI can.

- AI-driven portfolio recommendations

Imagine you want a personalized investment strategy. An AI assistant can analyze your spending, goals, and risk preferences and suggest one in a matter of minutes. It also aligns your portfolio with any changing conditions and market fluctuations. - Risk assessment and predictive analytics

It is a must for financial institutions to estimate the risk of loans, trades, or investments. Databases and datasets are massive, so an AI-powered personal finance assistant is handy to predict defaults or any market downturns (before humans even notice). - Fraud detection and anomaly spotting

When we have 2 million transactions, it can be difficult to notice a suspicious one. However, AI will not leave it unnoticed. They are trained to flag any unusual behavior in seconds. It protects customers from being hacked and institutions from any breaches or hazards.

Altogether, these measures only help human agents - they are to decide whether that or another flagged transaction or suggested portfolio is worth consideration.

Improving customer experience

Even if you represent a company in finance, you are a client yourself. And what do all customers hate? Waiting and friction. That’s what AI assistants help with, almost at every stage of financial interaction.

- Personalized financial advice

For example, there’s a student who needs advice on how to save on fees. Or a retiree who is looking for low-risk investments. AI tools are designed to give tailored recommendations to match individual needs and preferences. - 24/7 support

Humans need breaks, vacations, and, for Pete’s sake, sleep. However, AI assistants don’t need any of that. This way, these I-don’t-need-coffee-breaks assistants are available 24/7 to make sure customers get the needed answers anytime and anywhere. - Faster query resolution

There are many minor queries that need to be solved. For example, someone needs to reset a password or cancel some transaction. There’s no sense in waiting on hold for 15 minutes to solve a 5-minute question. AI assistants can handle that accurately and instantly.

For your understanding, the benefits AI tools bring for customers are just the norm nowadays, not a luxury.

Are There Any Compliance Considerations for AI in Finance?

Of course, not everything is smooth sailing. If you remember, I’ve already mentioned in this article that finance is one of the most strictly regulated industries. And it’s so for good reasons. This industry is about dealing with people’s trust, money, and privacy. So, are there any challenges? Of course. The task is to push innovation without breaking any rules. Is it possible? Yes! Let’s discover how.

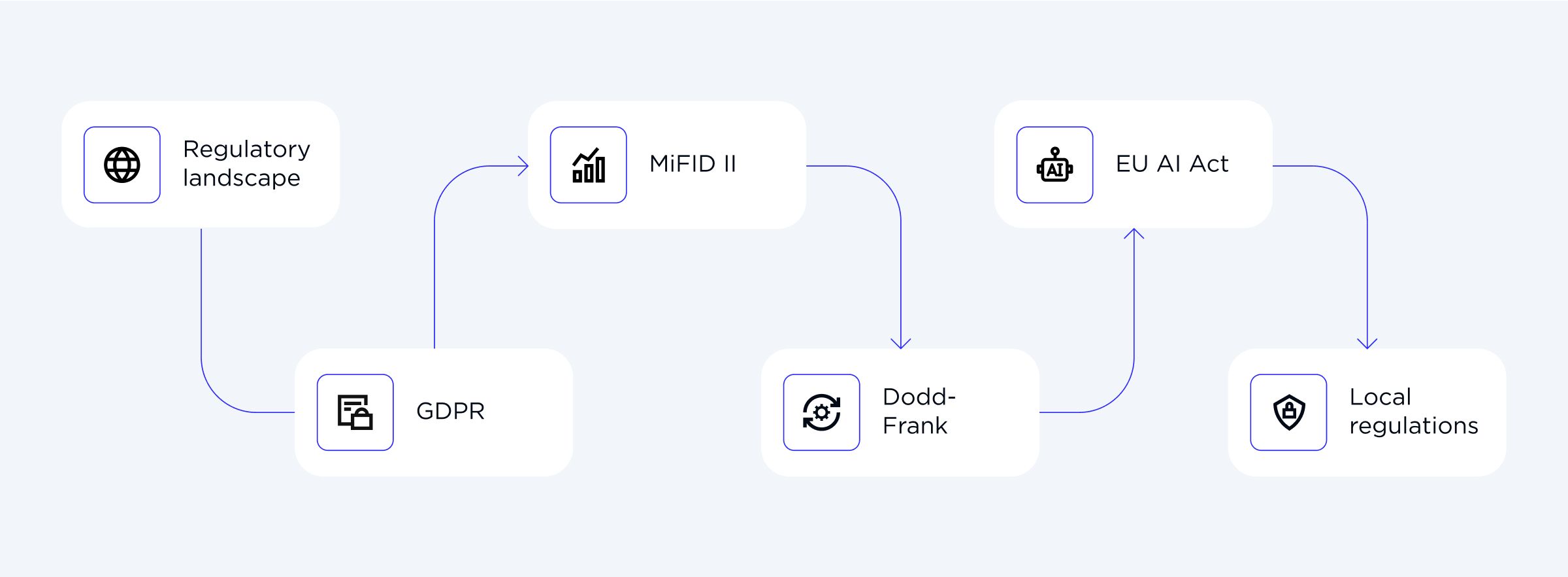

Regulatory landscape

Finance doesn’t operate in a vacuum. Every AI system and any AI virtual financial assistant must (and I highlight that MUST) follow and comply with strict global and local regulations.

- GDPR (EU)

Ensuring customer data protection and consent. - MiFID II (EU)

Supervising transparency in investment services. - Dodd-Frank (US)

Implementing consumer protections and oversight (after the 2008 crisis). - EU AI Act (EU)

Setting transparency, risk management, and accountability requirements for AI systems.

These are just a few examples of regulatory standards. Local regulators in different countries have their own rules and layers of complexity when adopting AI in finance. What does it mean? It means that the same AI assistant in Canada may not comply in Ukraine. AI developers have an important task - to balance innovation across different legal regulations without slowing down the process.

Data privacy and security

Compliance is not the only “must”. Privacy and data security when dealing with finances are non-negotiable. When you are planning to allow AI assistants to process highly sensitive financial data, you have to mark security as a top priority.

What can be done?

- Take measures to protect customer data and records against breaches.

- Establish ethical handling of data with transparent use without sneaky data collection or misuse.

- Design and train your AI models securely and don’t expose raw personal information.

You should remember that the financial industry is not one that can afford any mistakes. Trust can be destroyed overnight with just one security breach.

Let’s build a powerful AI financial assistant for your company

CONTACT USAuditability and explainability

Over the years of experience, I can say that one of the biggest compliance hurdles is explainability. It is obvious that no regulator will accept “the algorithm said so” as a justification. Let me explain what I mean.

When we talk about AI explainability in finance, regulators and customers want clear and plain-language answers to decision-making questions. For example:

- Why was my credit score lowered?

- Why was my account temporarily frozen?

- Why was this insurance claim denied?

- Why is this customer flagged as high risk?

- Why was a loan rejected?

- Why was a transaction flagged as suspicious?

- Why did the model suggest a specific investment?

As long as answers are clear and explainable, customers and institutions can make the right decisions without facing compliance risks or experiencing frustration.

Innovation and Compliance: How To Balance the Two?

So, the main question is, “How do you achieve the balance between innovation and compliance?” As the financial industry doesn’t have the luxury to choose one, we’re going to discover what you can do to reach both.

Integrating compliance from the start

Always make sure to put compliance as a priority from the very beginning. What does it concern?

- Privacy by design

Establish and in-build data protection into AI models from day one. - Compliance by design

Before deployment, ensure all AI systems align with regulatory frameworks. - Cross-team collaboration

All stakeholders must work hand-in-hand - AI developers, legal experts, and compliance officers.

When you follow this approach, you can avoid costly redesigns or regulatory pushbacks.

Implementing risk management strategies

The main approach in risk management is about anticipating any problems, not fixing them. How can you make it happen?

- Continuous monitoring

Regularly check AI models for any drift or inaccuracies. - Stress testing

To learn how AI behaves under extreme customer or market conditions, occasionally run “what if” testing. - Updating systems

AI must evolve with regulations. So make sure to update compliance.

Exploring case studies of successful implementation

Well, there is a phrase “lead by example”. And there are many financial institutions that already do so. So, you can always check how they manage to walk on this innovation-compliance tightrope.

- Banks use cases

There are use cases of AI financial assistants that screen fraudulent transactions and keep regulators happy with detailed audit reports. - Investment firms use cases

Investment companies started integrating AI-driven robo-advisors to suggest customers with personalized portfolios. These recommendations are backed by compliance models. - Compliance lessons from successes and failures

Both accountability and transparency are non-negotiable, no matter whether it’s a success or a failure.

One of the success stories is JPMorgan Chase. They introduced their COiN (Contract Intelligence) platform that can process commercial loan documents. What is the result? They can save about 360,000 hours per year, bringing 99% accuracy and a smoother audit process.

On the other hand, some failure examples also exist, and we should learn from them. The UK's Financial Conduct Authority (FCA) issued warnings to fine trading firms for compliance failures. The problem was with outdated policies, unclear documentation, and inadequate governance structures.

Are there any takeaways? For sure!

Exploring the Future Trends in AI Assistants for Finance

I don’t actually like to get ahead of ourselves. However, better be prepared. So, when speaking about the anticipated future trends in financial digital assistant development, I can’t help but mention that its evolution in the finance industry isn’t even planning to slow down. So, what’s on the horizon?

| Future trend | What will it change? |

| Generative AI | This tech is supposed to improve financial advisory services. It means companies will receive smarter and conversational systems to build more or even highly personalized roadmaps and recommendations. |

| AI-powered solutions | These tools will significantly enhance regulatory reporting. It will reduce manual workload due to automated compliance reports that regulators will receive. It may prevent human errors as well. |

| Ethical AI frameworks | This technology will eliminate ethical concerns. As a result, institutions will implement ethical guidelines for personal finance assistants to prevent bias, maintain trust, and guarantee fairness. |

| Multilingual capabilities | As finance is a globalized industry, multilingual AI assistants are super handy. They will seamlessly switch between languages (and even slang or regional dialects) with various customers. |

| Blockchain integration | Such an integration is essential for the future of finance. Integrating AI assistants with blockchain will create an environment of secure and transparent transactions. As a result, it will improve clients’ trust. |

To sum it up, I can say for sure: AI in personal finance will evolve significantly both in the level of responsibility it can take over and the complexity it can handle.

Wrapping Up: Building AI Financial Assistants with OTAKOYI

As you might have understood, the finance industry stands on two powerful pillars:

- The first one is innovation with its smart assistants, quick decisions, satisfied customers, and automated processes.

- The second one is compliance with a high level of trust, safety, and security measures.

The only way to walk the path in financial services is to keep those pillars in balance.

AI virtual financial assistants are designed exactly the way to keep that balance. They are made with compliance in mind. However, they take innovation to another level and help transform your business, keeping it more transparent. easy-to-use and trustworthy.

So, if your company is interested in enhancing the business, ensuring your professionals focus on strategy and complex tasks while AI handles the routine and the data-heavy tickets, you’ve reached the right address. We, at OTAKOYI, believe that the future of the finance industry will be decided by how well you align human expertise and AI capabilities. Ready to improve your business to stay ahead of the competition?