Cybersecurity in Fintech: challenges and vulnerability

The modernity, sophistication, and widespread availability of financial technology (Fintech) are both a blessing and a curse. On the one hand, managing your finances has become an effortless and swift endeavor; on the other hand, cyber threats still remain a major cause of alarm. Companies are in need of a reliable solution to their fintech security concerns, and that is precisely what we would like to share with you: all the possible explanations for the numerous cyber attacks in the Fintech industry, what the Fintech policies and regulations are as well as a little guide on how you can create a secure fintech solution.

Fintech: a cyberattack magnet

After the banking industry has practically shifted to the digital environment, so have the criminals changed their strategies and now pull even crazier stunts. Financial organizations remain the desired target surpassing other online industries and, according to Statista, reaching a shocking 23.6 percent of phishing attacks worldwide in the first quarter of 2022. According to the research, we, unfortunately, can make a conclusion that criminals have achieved great progress in arranging personal data violations and security incidents. The good thing is that we know what the reasons behind it are.

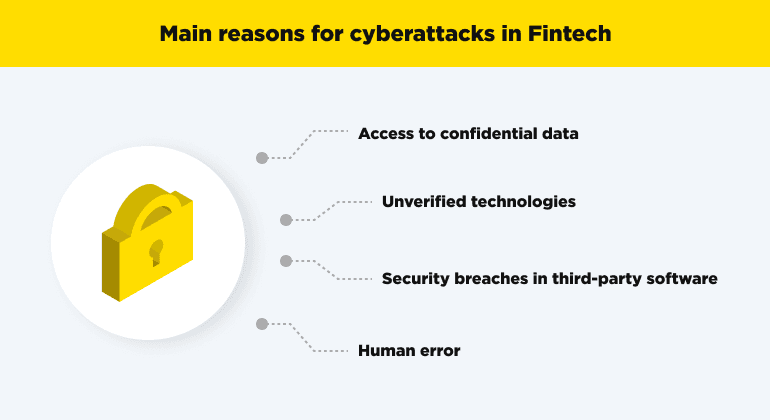

Reason 1. Access to confidential data

Data is the Holy Grail in our Information Age, and obviously, it is our most prized possession. Due to the financial service sector being home to numerous data clusters, providing financial transactions, credit reports, card payment info, geolocation, and special categories of other personal data, all this makes Fintech a tempting target for cyber threats. Since COVID-19, we’ve witnessed a great digitalization surge, and needless to say, the number of cyber-attacks has increased worldwide. Phishing emails or unauthorized transfers, as well as the removal of data, are the main outcomes of data leakage, according to IT security professionals in a recent Statista survey.

Reason 2. Unverified technologies

As yet another COVID-19 consequence, digitalization has brought competition among businesses, Fintech not being an exception. Since financial technologies are ever-growing data-driven innovations, it’s very easy to get caught up in the race to conquer the market. Businesses often feel the pressure to constantly follow the trends and implement cutting-edge digital products and services to impress the clients, only to understand too late that brand-new doesn’t necessarily mean proven. All these state-of-art approaches may trigger new cyber attacks in Fintech, prompting criminals to develop out-of-the-box methods of security hacking.

Reason 3. Security breaches in third-party software

Using third-party software security products may also be a pathway to a safety crisis. It occurs when Fintechs decide to merge traditional banks, financial security providers, and fintech startups by collaborating with third-party vendors. This is a risky endeavor because the given third-party software can be vulnerable to a possible data breach leading to nasty consequences: not only do attackers easily access the credentials of the victim's online accounts, steal their sensitive data and personal information and withdraw large sums of money. The reputation of your company suffers immensely, not to mention all the financial losses you are subjected to.

Reason 4. Human error

Surprisingly enough, most of the data breaches (95%) are caused by human factors. Additional staff training is highly required as the fintech industry makes use of the latest technologies, constantly expanding boundaries and improving user experience. Once again, we have to mention the pandemic because all the continuous lockdowns have led to a significant decrease in the efficacy of corporate training. What is more, each worker is on the line of becoming a victim of a potential phishing attack.

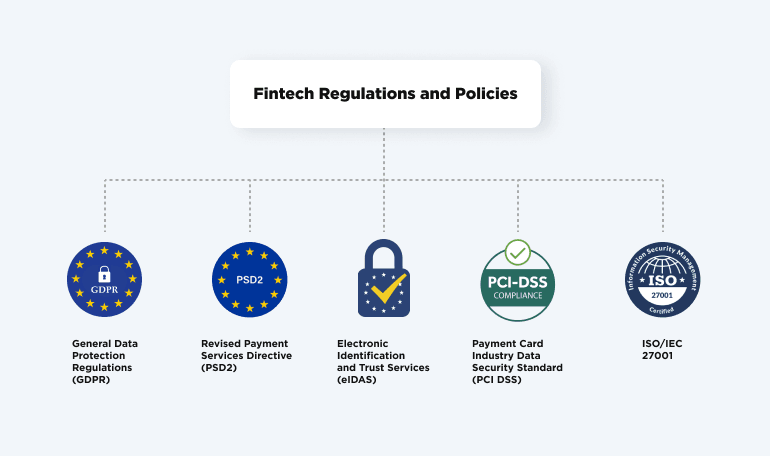

Fintech Regulations and Policies

Conforming to your company’s location besides the markets you selected, there is a broad range of cybersecurity stipulations for Fintech applications. Take a look at some of the standard policies and regulations for data security in the Fintech industry:

- General Data Protection Regulations (GDPR). If you plan to cooperate with EU residents and businesses, you might want to consider complying with this regulation.

- Revised Payment Services Directive (PSD2). Overlapping with GDPR, this EU directive regulates e-payment services.

- Electronic Identification and Trust Services (eIDAS). Yet another EU regulation for international electronic transactions with a common legal framework.

- Payment Card Industry Data Security Standard (PCI DSS). Major payment networks such as MasterCard and Visa oblige service providers to verify their digital products with this standard in order to collect, analyze and implement credit card information.

- ISO/IEC 27001. This international Fintech security standard aids financial organizations all over the globe in maintaining secure data management systems. On the flip side, the range of requirements depends on a given company’s size and location.

Suppose you have any doubts about the right regulation policy for your business. In that case, OTAKOYI can help you build a secure Fintech solution while employing thoroughly examined frameworks and methodologies and providing even more useful insights!

How do I make a secure fintech solution?

Whether you own a top-ranking financial establishment or a smaller Fintech company, or even a startup, and regardless of your IT security budget, ensuring the maximum level of protection is indeed the smartest move with the most benefits.

In order to secure the sensitive data of your customers nowadays, you can’t simply implement user authentication and call it a day! Any dimension of the workflow will only thrive when security issues are prioritized and systematically applied by the team involved.

Ready to build Fintech software?

contact usFollow the latest fintech compliance regulations

We’ve already shared some of the standard Fintech compliance regulations here, don’t forget to check them out! Following the latest fintech compliance regulations is crucial for establishing a secure fintech solution. Yes, anti-money laundering (AML) compliance doesn’t come cheap, but you can’t risk tarnishing your reputation and losing money because you’ve failed to secure your network and the sensitive data of your clients. One of the brightest examples of a company ignoring cybersecurity is the notorious Equifax Inc. data breach in 2017, which exposed the personal information of some 147 million people. As a result, the company agreed to pay $600 million in a sweeping settlement agreement with federal and state authorities.

Build a security-focused strategy

In order to protect your digital product and client’s data from Fintech cyber threats, you may consider the following steps:

- Establishing internal compliance. Organize inner processes according to the global and local fintech laws, policies and safety standards.

- Managing risks. Risk assessment is the key process to undergo. Monitor and mitigate any possible danger and be prepared to address incidents.

- Providing efficient staff training. There should be a balance between implementing cutting-edge technologies and training your employees who will have to deal with them firsthand. By committing big chunks of your budget to make your employees aware of the nitty-gritty of all the procedures, you ensure a solid security strategy implementation.

- Selecting trustworthy partners. Reliable partners, be it a whole development team or a third-party solution, only boost your Fintech app security confidence.

- Upgrading cybersecurity approach. Treat cybersecurity as a concept that has to be the foundation of your company’s culture and each employee’s behavior, not just a necessary step to protect personal data. In this realm, being an overthinker may be a huge advantage since it makes you hyper-aware of potential risks, thus resulting in a faster reaction to any security threat.

Stick to a security-centered development life cycle

To assure the security of customers’ products and services, OTAKOYI has established a set of effective practices that we like to call a development life cycle.

We use a wide variety of tools depending on specific tasks (e.g., static code analysis to analyze the source code or access control matrix that defines the rights of every item within the system).

Our team implements the DevSecOps approach, which integrates development, security, and operations through the development cycle, allowing rapid releases, reduced costs, early error detection, and advanced security.

Testing is yet another must-have procedure for any Fintech solution. OTAKOYI prefers implementing autotests as it has been proven to be far more cost and time-effective, requiring shorter amounts of time and less budgeting than manual testing.

Build Secure FinTech Solutions with OTAKOYI

Now that you have familiarized yourself with the possible risks and pitfalls of the Fintech industry and the life-saver a great Fintech security system is, you may be wondering where to start and where you can find a reliable team to ensure security and stability for your company. OTAKOYI offers a wide range of services and has years of experience under its belt when it comes to developing a top-notch Fintech security solution abiding by the latest Fintech compliances and frameworks. We’ll help you find and implement the best solution for your financial organization and guide you through all the ups and downs of the process.

Let’s sum up

Fintech is an extremely attractive target for cyber-attacks, and we’ve seen how badly it may damage a business and ruin reputations. Implementing a solid security system is a must in the Fintech industry, despite the size, location, and budget of your enterprise. Conforming to the newest regulations and policies, developing a cybersecurity mindset among your employees, and creating the best Fintech security solution will grant you safety and prosperity. OTAKOYI will gladly consult you and give key directions to take safety-related measures in our Information Age and provide excellent protection of your client's personal data!