Financial services and banking are the industries that every person and every business is strongly dependent on. With all the innovations and inventions, banking is going through a heck of transformation as well.

This article is devoted to tackling the topic of the new-day upgrade in finances that is generative AI in banking. For you to be more into the theme, depending on the usage, generative AI can potentially save the banking sectors up to $340 billion annually, according to McKinsey. Sounds unbelievable, don’t you think? Let it be the first reason why you should jump on this bandwagon and implement Gen AI for your institution.

What Is the Significance of Generative AI in Banking?

Generative AI is transforming banking, making it more efficient, secure, and customer-friendly. AI is really becoming a critical tool for success. Moreover, Accenture forecasts that by 2028, the banking industry is about to witness a 30% increase in employee productivity due to the implementation of AI solutions.

What makes Gen AI so important?

#1 First of all, banks can significantly enhance customer service. Imagine chatbots and virtual assistants that are available 24/7, providing personalized financial advice tailored to each customer's needs.

#2 Security is another area where generative AI shines. It can analyze enormous amounts of transaction detail to spot suspicious patterns, helping to prevent fraud before it happens.

#3 Operational efficiency is also boosted by AI. Routine tasks like document processing, data entry, and regulatory compliance checks, which are often time-consuming and error-prone, can be automated.

#4 When it comes to risk management, generative AI offers precise assessments based on market trends and financial indicators.

#5 Generative AI also accelerates key processes like credit approval and loan underwriting.

As you can see, innovation in the banking sector is driven by AI. It identifies market gaps and unmet customer needs, helping banks develop new financial products and services that make them stay ahead of the competition with all due ethical considerations.

Defining the Primary Benefits of Generative AI in Financial Services

We have already mentioned some of the key opportunities and benefits that Gen AI offers. It really goes beyond traditional methods and transforms banking operations.

We are more than sure that banks are only eager to take advantage of these opportunities. A 2023 survey by KPMG revealed that 26% of organizations had already implemented at least one generative AI solution or planned to do so within six months. Additionally, 64% of financial service executives indicated that their organizations were ready to allocate budgets for AI projects. Why do you think it happens? The answer is obvious - the benefits are so great that are worth every penny of investment. Let’s discover more.

Optimized processes through automation

Generative AI excels at automating routine tasks with impressive accuracy. Processes like document review, data entry, and compliance checks, which are often tedious, can be handled by AI systems. This frees up human resources to focus on more impactful activities, leading to greater efficiency.

Enhanced operational efficiency

AI-driven technologies enhance workflows, reduce processing times, and improve decision-making. This leads to fewer errors, cost savings, and overall better performance. Data analysis, report generation, and document processing become more streamlined, creating a more responsive financial ecosystem.

Personalized and customized financial products

Generative AI enables banks to offer customized products and services that meet individual customer needs. By analyzing customer data and preferences, AI can suggest investment strategies, personalized savings plans, and tailored loan options. This level of personalization not only boosts customer satisfaction but also builds long-term loyalty.

Improved interaction for better customer experience

Generative AI in banking is revolutionizing customer interactions. Virtual assistants and AI-driven chatbots provide natural language interactions, offering customers personalized communication and support. This improvement in engagement significantly enhances the overall customer experience.

Beyond simple chatbots, banks are now adopting advanced AI assistants for banking that combine multiple functions into one intelligent hub. These assistants support agents and customers alike — handling inquiries, automating document analysis, guiding compliance processes, and even suggesting tailored financial products.

Upgraded security measures

Generative AI strengthens security within financial institutions by analyzing vast datasets to detect unusual patterns and potential security breaches. This technology supports the development of advanced cybersecurity measures, including better authentication protocols and protections for sensitive financial information.

Fraud identification and prevention

As we have already mentioned earlier in the article, generative AI is a powerful tool for detecting and preventing fraud. It analyzes transaction patterns, user behavior, and other relevant data. As a result, it can identify anomalies that signal fraudulent activities, helping banks prevent any potential threats. Super-important fact for you to know is that according to Mastercard, this technology is bound to help banks improve their fraud detection rate by 20%, with rates reaching as much as 300% in some cases.

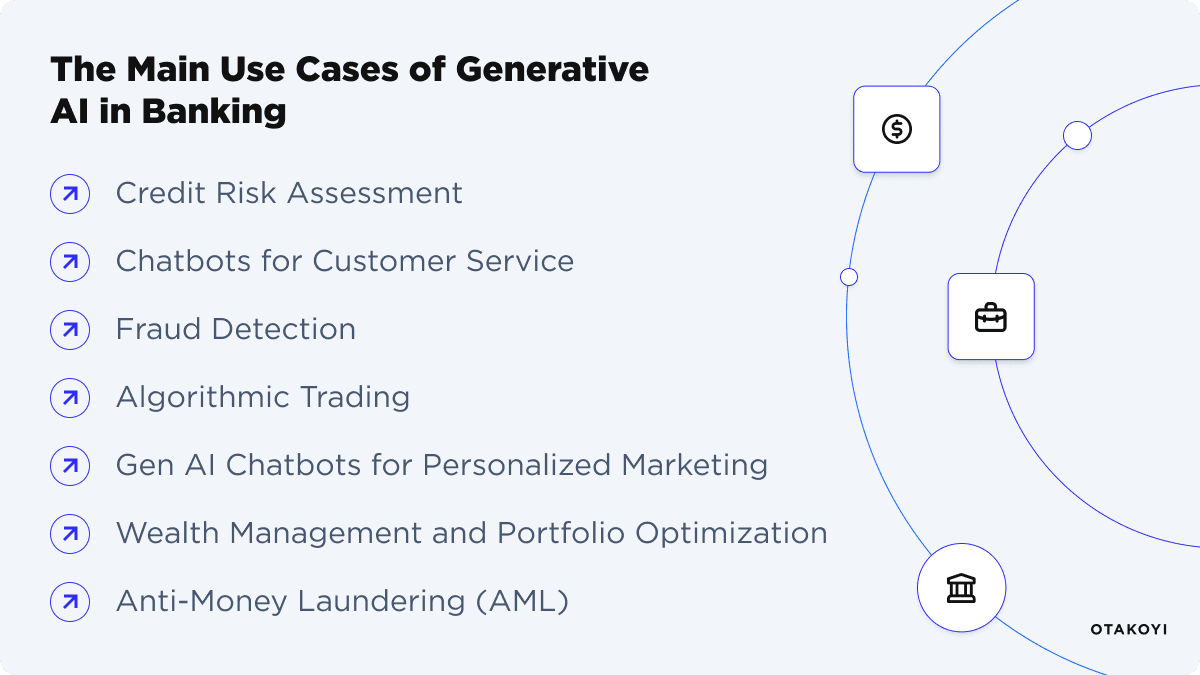

What Are the Main Use Cases of Generative AI in Banking?

Now, let's explore some of the most effective examples of the application of generative AI in banking.

#1 Use case: credit risk assessment

As you may know, this process was previously based on statistical models and transactional histories. However, generative AI brings credit risk assessment to a completely new level of accuracy. AI can assess an applicant's creditworthiness more accurately than ever before by generating various credit scoring models and analyzing large datasets.

When doing that, it takes into account such risk factors as transaction and financial history, social data, and economic indicators. What is amazing about Gen AI is that it can identify even minute patterns and correlations that human analysts might just miss out on.

We believe that it has a significant effect. Banks are able to extend credit to a wider range of clients (including those who may have previously been considered too risky), making quicker, more certain decisions.

#2 Use case: chatbots for customer service

Generative AI-powered chatbots and virtual assistants are literally revolutionizing customer service in the banking system. What do you get? Natural language models, personalized communication, and contextual awareness. We bet you’re excited about such advancements! This way, artificial intelligence ensures that it generates relevant and personalized responses to customer inquiries, leading to higher satisfaction and loyalty.

To put it simply, the benefits of using chatbots and virtual assistants in banking include enhanced banking experience, reduced operational costs, and streamlined routine tasks. When customer service tasks are automated, banks can focus on delivering more value-added services and building deeper relationships with their customers. Such solutions are part of broader AI automation solutions, helping financial institutions reduce workload, speed up operations, and deliver seamless services across all customer touchpoints.

#3 Use case: fraud detection

Generative AI in banking has a significant edge in detecting and preventing fraud, especially by creating synthetic data that mimics fraudulent patterns. We’ve mentioned this application in benefits. But here, we wanted to expand on the actual usage of Gen AI as fraudulent transactions keep constantly evolving.

So, by implementing generative artificial intelligence, financial organizations can make the most of it and stay ahead of and prevent emerging fraud schemes, automate the identification of suspicious behavior, and reduce the need for manual review. As you can see, this approach not only minimizes financial losses from fraud but also strengthens customer trust and confidence.

#4 Use case: algorithmic trading

Modern finance has come to rely heavily on algorithmic trading, and generative AI has been essential to its development. To maximize investments and keep a competitive edge in the rapidly changing financial markets, banks and other financial institutions rely on AI-driven trading strategies.

In algorithmic trading, generative AI is unique due to its flexibility and capacity for learning. These models self-update constantly, responding with remarkable accuracy to shifting market conditions and new trends. As a result, trading strategies become more effective and maximize returns while lowering risks.

The advantages for banks are substantial. Their ability to execute trades quickly and accurately improves their market position and profitability. Additionally, the investigation of novel trading tactics that were previously unthinkable is made possible by generative AI.

#5 Use case: gen AI chatbots for personalized marketing in banking

Extensive customer data, such as transaction history, browsing habits, and demographic data, can be analyzed by generative AI models. AI can use this data to create highly customized marketing campaigns and customer-specific product recommendations.

This degree of customization surpasses standard email promotions. Generative AI in banking creates customized content, messages, and even product offerings that speak to the individual needs and preferences of each customer. This increases customer engagement and encourages loyalty, in addition to increasing conversion rates.

#6 Use case: wealth management and portfolio optimization

A range of financial data, economic indicators, market trends, and individual client profiles are analyzed by generative AI models. AI creates predictive models based on this data to suggest the best asset allocations and investment plans.

When opportunities and market conditions change in real-time, these models can dynamically adjust portfolios. With this strategy, banks can efficiently manage potential risks and optimize returns.

Banks benefit from it significantly. More individualized asset allocations and investment strategies from wealth managers can increase client satisfaction and loyalty. AI-driven wealth management also improves service scalability and lowers operating expenses.

#7 Use case: anti-money laundering (AML)

For banks, preventing money laundering and following regulations are of utmost importance. If you have read the article so far, you will not even doubt that Gen AI in banking is proving to be a potent instrument for improving Anti-Money Laundering (AML) procedures.

How does it happen? Generative AI models can examine vast amounts of financial transaction data, customer profiles, and past trends. These models help banks identify and prevent criminal strategies by not only identifying established money laundering techniques but also adapting to new and emerging ones.

It can also build predictive models that recognize patterns and anomalies that point to potential money laundering. These models are highly adaptive to new threats because they are constantly learning from new data.

Enjoy All the Benefits of Generative AI Solutions

Contact usDetermining the Challenges of Generative AI Implementation in Financial Services

We wouldn’t want you to think that implementing Gen AI is all about flowers and candies, as there are some challenges to overcome. However, when carefully managed, financial institutions can ensure long-term benefits. Let’s together discover the key challenges to face.

Compliance and regulations

You should be aware that navigating the complex web of financial regulations is one of the main obstacles to generative AI in banking. Strict regulations are in place to safeguard consumer interests, stop fraud, and uphold market integrity in the financial sector. For you to stay out of legal issues and uphold financial service industry standards, financial companies need to make sure that AI adoption is compliant with current regulations.

Integration with financial markets

We should note that financial institutions handle a wide range of financial instruments, intricate trading algorithms, and enormous volumes of real-time market data. The difficulty is in creating generative AI systems that can adjust to the intricacy and volatility of financial markets, guaranteeing precise forecasts and efficient decision-making in situations that change quickly.

Questions of bias and fairness for AI in banking

You must have already understood that generative AI is meant to generate outcomes based on data and trends, issues with fairness and bias may arise. AI models can inherit biases from historical data if they are not properly designed and trained, which would unfairly treat marginalized groups and exacerbate already-existing disparities. To guarantee that AI-powered decisions are impartial and fair, you need to take a proactive approach to resolve these biggest concerns.

Informed and transparent decisions

Because generative AI models are inherently complex, they frequently result in "black-box" decision-making. The financial sector needs to achieve transparency because regulators, clients, and internal stakeholders require financial firms to justify informed decisions. You just have to try to strike a balance between the sophistication of AI models and the demand for transparency.

Quality data availability for AI in financial services

Unfortunately, access to sensitive databases and accuracy may present difficulties for financial institutions. To prevent inaccurate data from compromising AI-driven insights, it is imperative for you to ensure high-quality data inputs. We believe that it is crucial to resolve data availability concerns to avoid knowledge gaps that can impair the functionality of AI models.

Implementing Top-Notch Generative AI in Banking With OTAKOYI

We all know that adopting generative AI in banking is a significant step that requires careful planning and strategic execution. That is why OTAKOYI is here to help your financial institution navigate this transformation with ease and peace of mind.

Our team of experts will work closely with you to understand your specific needs and challenges. We’ll develop customized generative AI solutions that align with your business goals, ensuring a seamless integration process.

What are the advantages of working with us?

#1 Profound expertise and knowledge

#2 Dedicated team of professionals

#3 Life-long learning and only the latest technologies

#4 Flexible and scalable solutions

#5 Customized and personal approach

Whatever you are looking for, OTAKOYI has the expertise to deliver the needed results. Our comprehensive approach ensures that you not only adopt AI solutions but also realize its full potential in driving your financial operations forward!

Final Words

How do you feel after reading through all these game-changing benefits and uses of Generative AI? To summarize our article we can’t help mentioning that this tool is revolutionizing the banking sector. Moreover, Gen AI offers a wide range of benefits, from enhanced customer service to improved security and operational efficiency. Always keep in mind that is comes with challenges that you have to overcome.

Our advice is simple - partner up with a dedicated team of developers and engineers and elevate your financial institution to a whole new level! Ready to start your journey? Make sure to get a quote from the OTAKOYI team.