The new insurance era has really improved with innovative generative AI. This article is going to focus mainly on gen AI as a contemporary tool and solution, which is really changing the sector. You should be aware that it’s not just a trendy term. It is a great and working solution that is transforming quickly.

What are the outcomes of it? Insurers get a chance to apply cutting-edge solutions that improve everything from risk assessment to customer experience. In this article, we'll look at how this innovative technology is being used in the insurance industry, along with some of the major advantages it offers. We do hope that this guide will help you understand why generative AI is the way of the future for insurance, regardless of where you are in your development process.

What Is the Role of Generative AI in the Insurance Industry?

As you may have already heard, generative AI is an innovative technology that largely relies on Large Language Models (LLMs) and machine learning (ML) techniques. The modern version of AI has advanced far beyond our imagination of what we had expected earlier. Nowadays, all industries, including insurance, are well-off with these top-notch computers that are sifting through massive databases to uncover all the patterns and make predictions.

You may ask, what makes generative AI in insurance so unique? To put it briefly, generative AI in the insurance industry refers to the use of advanced artificial intelligence solutions that can create new content, business insights, or solutions based on existing data. It may easily create various forms of content, such as personalized insurance policy documents, marketing materials, or customer communication.

Moreover, it can process and analyze large datasets to reveal patterns and trends. This way, an insurance company can use this AI tool to predict future tendencies, assess potential risks, and develop strategies. Unlike manual work, generative AI can produce automated responses to customer inquiries or claims. Altogether, companies that exploit this solution are able to implement personalized insurance products and services.

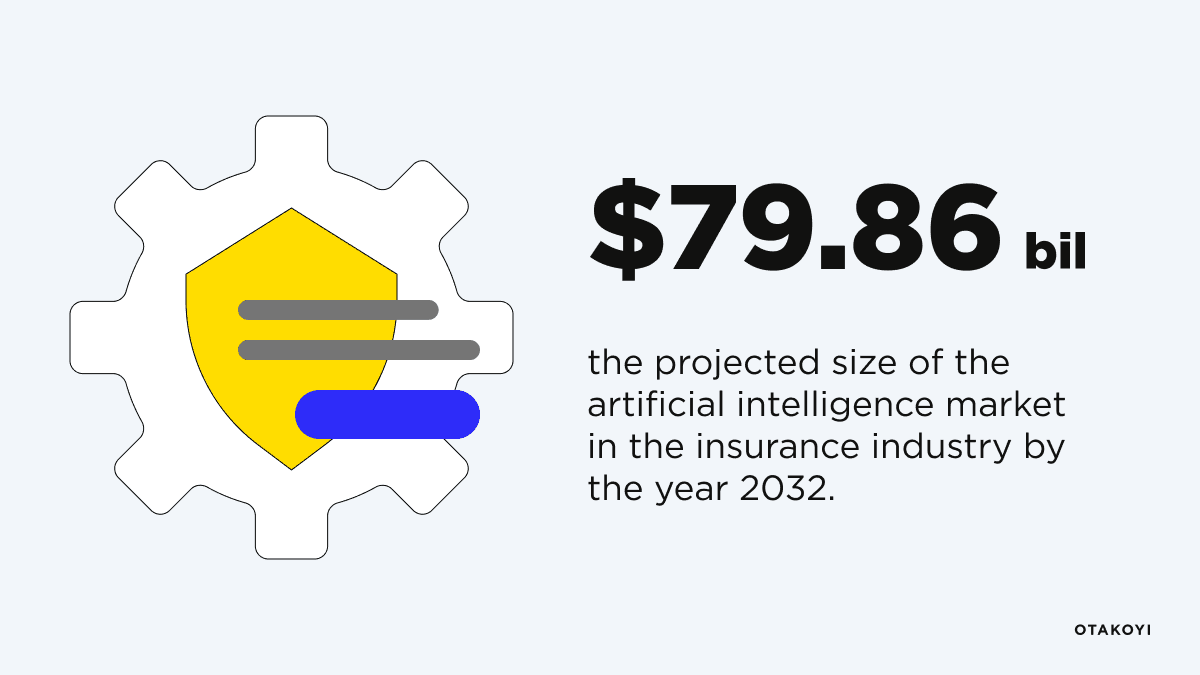

The real zest is the research results by the Precedence Research. It says that the global artificial intelligence in insurance market size was estimated at USD 4.59 billion in 2022, and it is predicted to be worth up to USD 79.86 billion by the year 2032, with a CAGR growth rate of 33.06% from 2023 to 2032. It is crucial to consider this information to stay ahead of the competition. What is more, a report by Sprout.AI found that about 60% of insurance companies are already actively exploring or implementing generative AI solutions.

Defining the Key Benefits of Generative AI for Insurance

Digital transformation is taking place in the insurance sector, and generative AI is leading the way. For businesses searching to improve productivity, accuracy, and customer happiness, generative AI provides effective and non-traditional solutions.

Later in this guide, we will list the most important advantages that generative AI in the insurance industry brings about. From AI-powered assistants to advanced data analysis, artificial intelligence enables insurers to stay competitive, innovate, and optimize operations.

#1 Enhanced risk evaluation

Generative AI refines the accuracy of risk assessments by analyzing vast datasets, leading to more precise underwriting and pricing strategies.

#2 Innovation in product development

You get a chance to leverage generative AI tools to create data-driven, personalized insurance products that meet evolving individual customer needs and market demands.

#3 Operational cost reduction

It allows for reducing costs by implementing customer service automation, transforming routine business processes, improving insurance claims processing, and minimizing human oversights with AI-powered solutions. Various virtual assistants can be real game changers.

#4 Insightful data analysis

Insurance providers are able to transform raw data into actionable insights. It allows them to make informed decisions and stay competitive in a rapidly changing market.

#5 Boosted customer loyalty

One of the best benefits is that the use of gen AI can help deliver personalized and custom experiences, improving customer satisfaction and retention through tailored interactions and services.

#6 AI Assistant for Insurance Agents

One of the most impactful applications of generative AI is the AI assistant for insurance. Acting as a single point of support, such tools combine multiple functions — from policy search and claims guidance to customer communication and document management. Instead of switching between several systems, insurance agents can rely on one intelligent assistant to streamline their daily tasks, save time, and focus on higher-value work.

A great example comes from our collaboration with a leading insurance company, where we developed an AI-powered document analysis tool. The solution automated the processing of complex documents, dramatically reducing manual effort and errors. This innovation not only optimized back-office operations but also freed up agents to better serve customers.

Enjoy All the Benefits of Generative AI Solutions

Contact usPractical Applications of Generative AI in Insurance

The insurance sector is going through a rapid transformation thanks to generative AI, which provides creative and advanced solutions that improve accuracy and efficiency. Here are a few major applications where this cutting-edge technology is having a big influence, from customer interactions to process optimization.

1. Streamlined underwriting

Generative AI in insurance simplifies the underwriting process by analyzing applicant data quickly and accurately, providing advancements for insurers to see the whole picture and not waste their precious time on routine tasks.

2. Elevating customer experience

AI-driven tools personalize interactions, offering customers tailored advice and support, making their insurance journey smoother and more satisfying.

3. Faster claims processing

Automate and expedite the claims process with AI, reducing the time it takes to assess, approve, and pay out claims, which enhances customer trust and satisfaction.

4. Advanced fraud detection

AI uncovers subtle patterns that might indicate any fraudulent claim or activity, helping insurers protect their assets and maintain integrity.

5. Predictive insights and useful data

Utilize AI to forecast trends and risks, allowing insurers to be proactive in their strategies and decision-making.

6. Enriched data usage and analysis

Generative AI models enhance the quality and depth of data by filling gaps and providing richer datasets for better analysis and decision-making.

7. Efficient policy creation

Automatically generate and customize policy documents that meet regulatory standards and customer requests and needs, saving time and reducing errors.

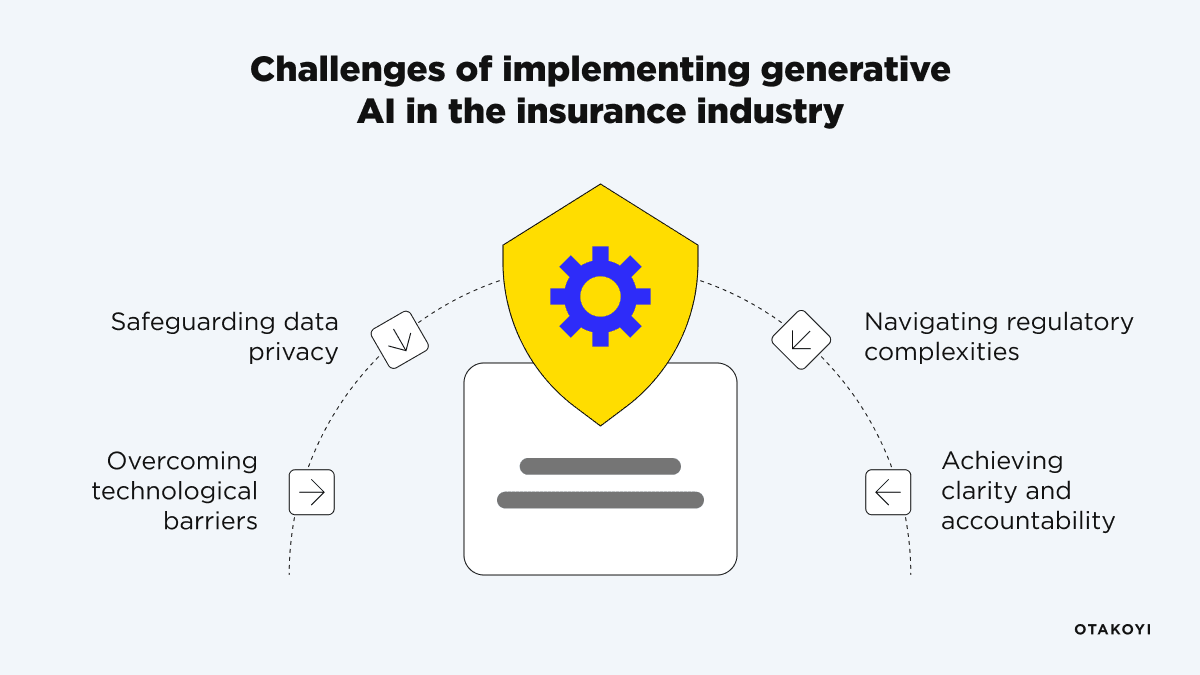

Discovering the Challenges of Implementing Generative AI in the Insurance Industry

Although generative AI in insurance has enormous potential to transform the insurance sector, there are some addressed challenges in implementation that must be solved. The complicated world of data privacy, legal requirements, and technology constraints is one that insurers have to deal with. We look at some of the main obstacles businesses encounter when incorporating AI into their daily operations below.

Safeguarding data privacy

Considering generative AI processes vast amounts of sensitive information, it is a top priority to ensure data privacy. Insurers must be rigorous in protecting customer data from any breaches and misuse. It is a real challenge to navigate the delicate balance between innovation and security.

Navigating regulatory complexities

The insurance industry is heavily regulated, and generative AI introduces new challenges in compliance. There are existing and evolving laws and regulations to follow. It is crucial to stay ahead of those norms and ensure AI systems adhere to strict regulatory standards. Otherwise, you may be likely to get penalties and lose trust.

Achieving clarity and accountability

Generative AI systems can sometimes be complex and difficult to understand. More and more people are raising concerns about transparency. That is why insurers need to ensure that AI-driven decisions are explainable and accountable, providing clear reasoning that stakeholders can trust.

Overcoming technological barriers

While generative AI offers great potential, it also comes with technological obstacles and hurdles. From integrating AI with existing systems to dealing with limitations in AI capabilities, insurers must address these challenges to fully realize the key benefits of AI.

What About Starting Your Personal Generative AI Journey With Otakoyi?

If you're looking for ways to fully master the power of gen AI in insurance, Otakoyi is the partner you need. With a proven track record in AI development services, our team offers tailored solutions that address the unique challenges of your insurance business.

Would you like to find out how we can help you? Let’s tackle!

#1 Customized AI solutions

Otakoyi develops AI models that are fine-tuned to meet your specific needs, whether it’s enhancing customer experience or optimizing risk assessments.

#2 Seamless integration

Our team ensures that AI technologies are smoothly integrated into your existing systems. It significantly minimizes disruption and maximizes efficiency.

#3 Expert guidance

From navigating regulatory requirements to ensuring data privacy, our dedicated team provides expert advice to help you implement AI responsibly, smoothly, and effectively.

#4 Ongoing support

Beyond effective implementation, Otakoyi offers continuous support and updates, ensuring your AI solutions stay ahead of the curve in a rapidly evolving insurance industry.

#5 Scalable solutions

Otakoyi’s AI offerings are designed to grow together with your business. You can always scale up as your needs evolve without compromising on performance or functions.

#6 Client-oriented team

Otakoyi takes the time to understand your specific goals and challenges, crafting AI solutions that not only meet but exceed your expectations.

Starting your generative AI journey with Otakoyi means partnering with experts who understand the insurance sector and are committed to helping you succeed. Your success is our success as well!

Conclusion

Generative AI stands out as a game-changer that is promoting innovation and efficiency everywhere in the insurance industry as it continues to change. The possibilities of this artificial intelligence technology are enormous and continue to grow, ranging from improving risk assessment to customizing customer experiences. But generative AI has its own set of difficulties, just like any other powerful tool. These difficulties are especially noticeable in areas like data privacy and regulatory compliance. Understanding and successfully navigating these obstacles is the key to realizing its full potential.

The OTAKOYI company is always available to help you accomplish that. Our proficiency in gen AI, coupled with our in-depth understanding of the insurance sector, enables us to offer solutions that not only tackle immediate problems but also get ready for future ones. Cooperating with Otakoyi, you are able to ensure that your insurance business will receive the guidance and support necessary to succeed in the market. No matter what development stage and involvement of the generative AI you have. Everything that you need is your desire to expand and innovate your knowledge and business altogether.

Ultimately, adopting generative AI is about changing how you do business and remain competitive. You are also able to provide a much better insurance value chain to your clients. So, as you can see, it’s not just about keeping up with advanced technology trends. It's time to begin utilizing generative AI to shape the insurance industry's future now that it has arrived.