Implementing RPA in Finance & Banking: Benefits, Use Cases, and Process

What if we tell you there is a solution that can improve your productivity by up to 92% and compliance by up to 90%? Finance robotic process automation or RPA is an effective solution against extremely time- and cost-consuming tasks, like manual data processing. RPA technology is evolving quickly, with more financial institutions adopting it for finance processing, accounting, and audit.

This guide will focus on the benefits of RPA in finance, successful worldwide use cases, and ways it improves business processes.

Unleash the power of finance RPA and take your productivity to the next level! It’s time for the RPA revolution to reach your company.

RPA: What is it?

Let’s kick it off by answering the first question. What is RPA in finance? Robotic process automation is a technology that automates repetitive, manual, administrative, and time-consuming tasks across the platform. RPA is widely adopted across various industries, from healthcare to retail management. However, banks and finance and accounting departments use it to limit human intervention and error in the financial sector.

The basic RPA model has limitations to what task it can learn and perform. Yet, with advanced Machine Learning and Artificial Intelligence integration, you can have a software robot that can handle complex procedures and adapt to real-time data.

Gartner revealed that more than 80% of financial executives plan to implement (or already have) RPA in the work process. Let’s take a closer look at what is so special about RPA technology and how it can boost efficiency.

Benefits of robotic process automation for finance and banking

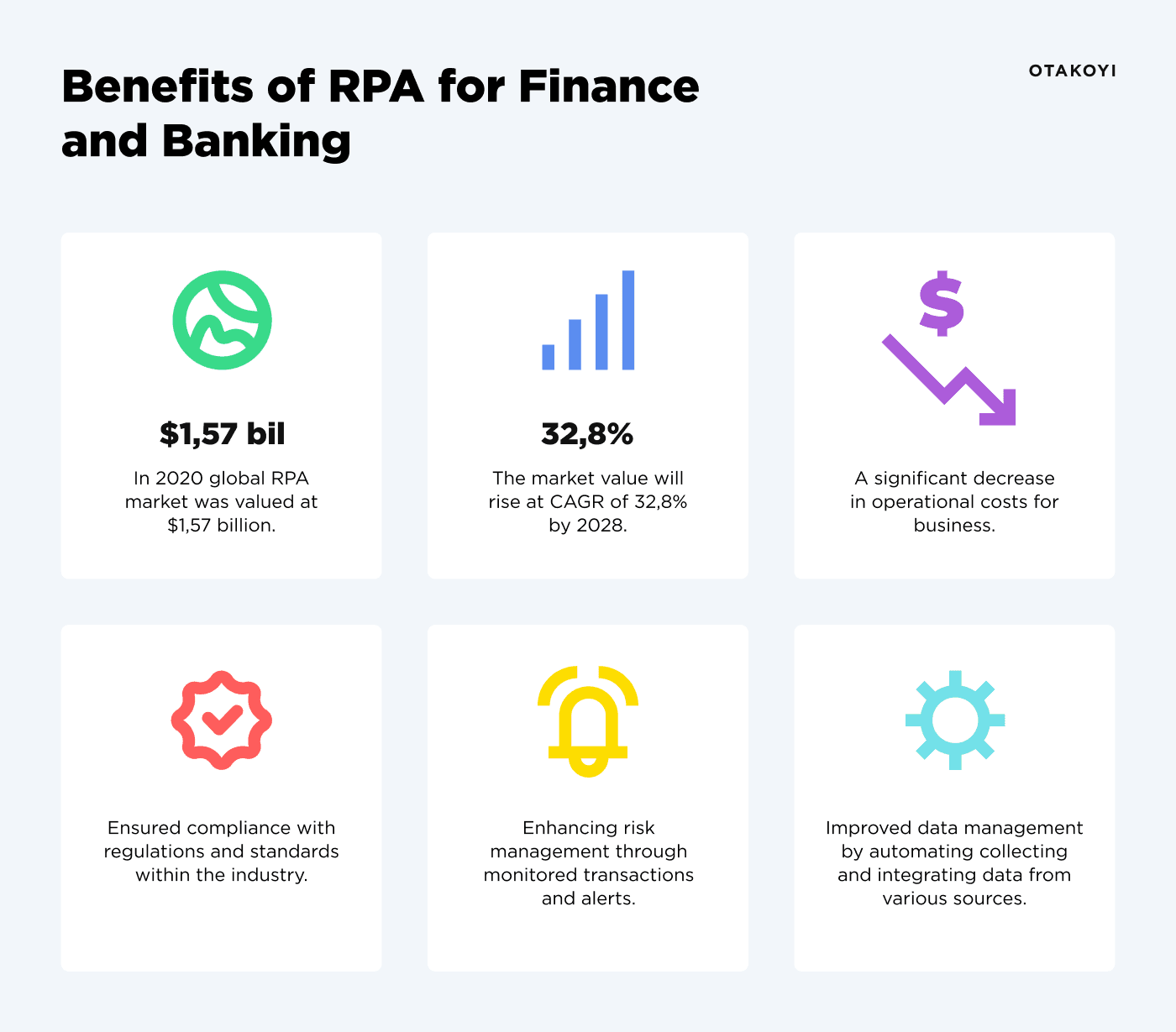

In 2020 global RPA market was valued at $1,57 billion. According to Grand View Research, those numbers will rise at CAGR of 32,8% by 2028. Such statistics highlight the necessity of implementing RPA in the business to improve finance function.

How can you benefit from finance robotic process automation? Here is a rundown of the top advantages:

- Lowering operational costs by automating manual and time-consuming processes;

- Minimizing human error and increasing output quality;

- Ensured compliance with regulations and standards within the industry by automating compliance checks and provisioning an audit trail of all processes;

- Improved accuracy and efficiency of the finance department through repetitive tasks automatization like data entry, reconciliation, and report generation.

- Enhancing risk management through monitored transactions and alerts and real-time view of potential risks;

- Elevated customer service in loan processing and other customer-facing activities, allowing employees to provide personalized service.

- Improved data management by automating collecting and integrating data from various sources for a more complete and accurate analysis.

What is RPA best for?

How can a robotic possess automation solution put into use and juice its full potential for the company’s gain? Here are some real-task examples where you can apply RPA for finance.

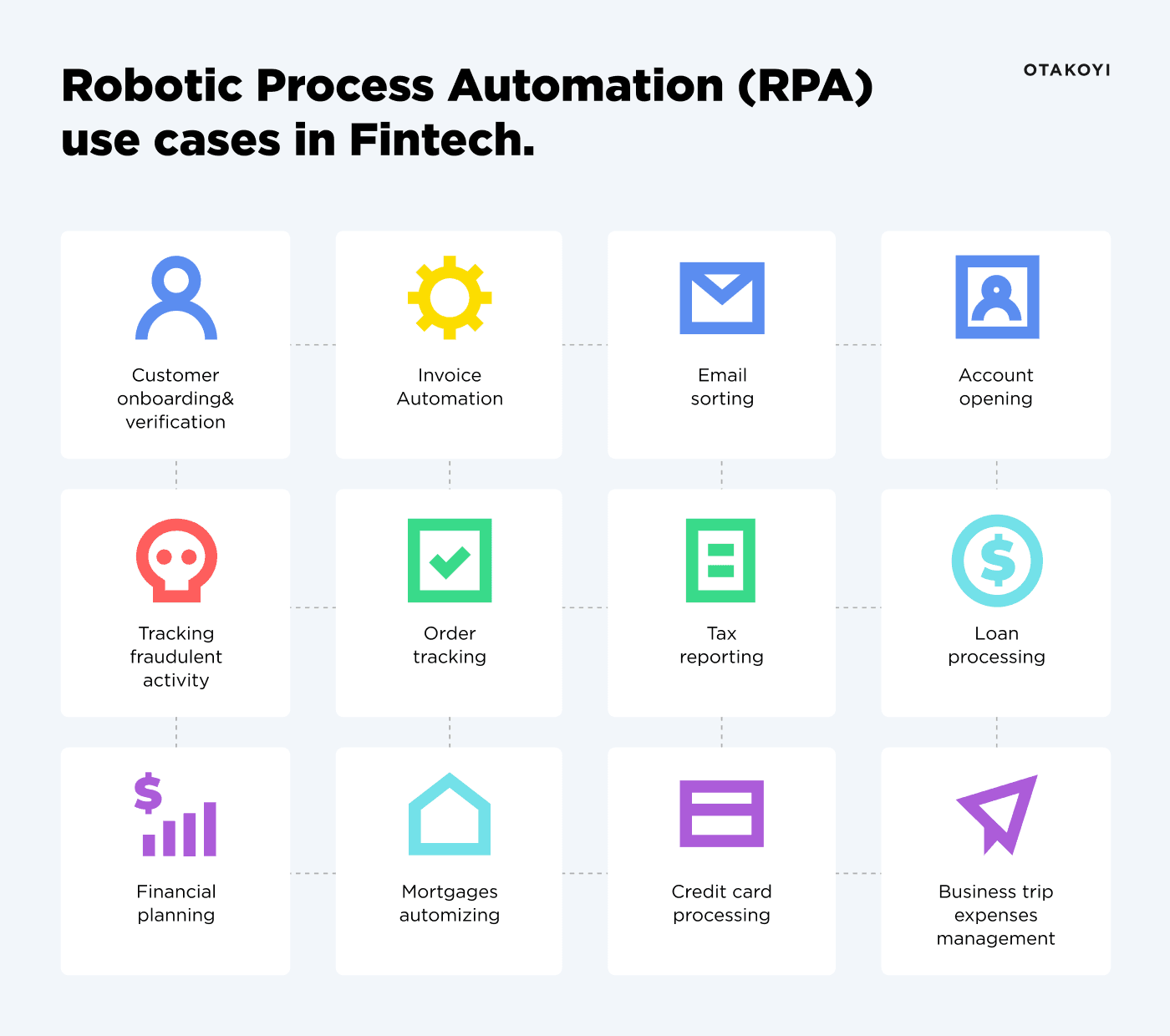

Customer onboarding& verification

You can trust finance RPA with the most important processes in the organization, like customer onboarding. Using character recognition, RPA collects information about the clients and registers all the personal details in the database.

Invoice Automation

Invoice processing is a repetitive and time-consuming task that takes away from your employee’s productivity. However, you can free up valuable time for your team and reduce the workload by trusting the process to RPA robots.

Email sorting

In the corporate world, emails are one of the most annoying things to deal with, primarily if you work on several accounts. By introducing RPA in your systems, you can have a bot manage incoming emails, sort them, save attachments, and forward them to the right employee.

Account opening

Instead of a tedious manual process, you can have fast and efficient bank account opening and registering that benefits your team and customers. RPA makes the process straightforward, accurate, and more direct.

Tracking fraudulent activity

One of the common use of RPA in finance is monitoring fraudulent activity. You can delegate to a software robot data entry and reports to help the compliance officers with a workload. Provide your professionals with more resources and productivity to track fraudulent risks and improve their decision-making.

Order tracking

Order tracking RPA robot can open requested files to copy and paste the link to new documents into the files, copy the email date, paste the addresses, and save the whole process.

Tax reporting

RPA bots can extract data from various sources, perform calculations, validate data, and generate reports. They can also handle tasks such as data entry, reconciliation, and submission of tax forms. Additionally, RPA bots work 24/7 without breaks, reducing the time needed to complete the tax reporting process. Robotic automation helps organizations to meet deadlines, ensure compliance, and minimize error risks.

Loan processing

Taking a loan is associated with a whole load of paperwork that stresses clients and employees. RPA with integrated Machine learning and AI technology can eliminate this stress from the organization and reduce loan processing time.

RPA bots can handle various tasks, such as data entry, document scanning, and information verification. You can automate credit checks, risk analyses, and loan amounts calculations to reduce errors and boost customer satisfaction.

Financial planning

Advanced RPA tools can help the organization with predicting future financial planning. The robot can analyze past, track present trends, and forecast future expenses. It can take the stress factor away from your employees, improve decision-making in the various departments, and help you build long-term financial plans.

Mortgages automizing

RPA bots can skyrocket mortgage processing times and improve accuracy, leading to a better customer experience. The bots assist with data entry, document verification, credit check, and more. RPA enables mortgage lenders to handle a larger volume of loans, increasing processing capacity and helping organizations to meet their business objectives.

Credit card processing

Just like mortgages, credit card payments, and processing can become a hustle-free process with robotic automation. With RPA, there is no need to go through multiple layers of verification and steps.

Business trip expenses management

Lastly, people tend to underestimate how much headaches from paperwork corporate business trips require. Therefore, you can delegate the bot to deal with management reports, bills, and invoices.

Ready to automate your Fintech business?

Contact usWhat does the RPA for Finance & Banking development process look like?

After learning all the benefits and perks of implementing RPA for your business, you must be eager to get started with development. So what does it take to power up your systems with finance RPA?

-

Discovery and identification phase. The first step is to identify which processes in the banking and finance sector can benefit from RPA and prioritize them based o the impact on the organization’s operations, efficiency, and customer satisfaction.

-

Solution design. The next step is to gather specific requirements to design customized RPA solutions, including defining process flow, identifying inputs and outputs, and determining the technology requirements. At this stage, you should validate your concept with the compliance officer to meet industry standards and regulations. RPA tool selection. Organizations should choose RPA tools that suit their needs based on the factors like cost, scalability, and integrations with other systems.

-

RPA implementation and testing. Before final deployment, we recommend testing the RPA tool in the real-life work cycle to ensure that it functions as expected and provides highly satisfactory results.

-

Deployment. After you validate robotic process automation works perfectly, you’re ready to introduce it into the production environment. However, ongoing monitoring of RPA performance is critical to identify opportunities for optimizations and validate it delivers desired results.

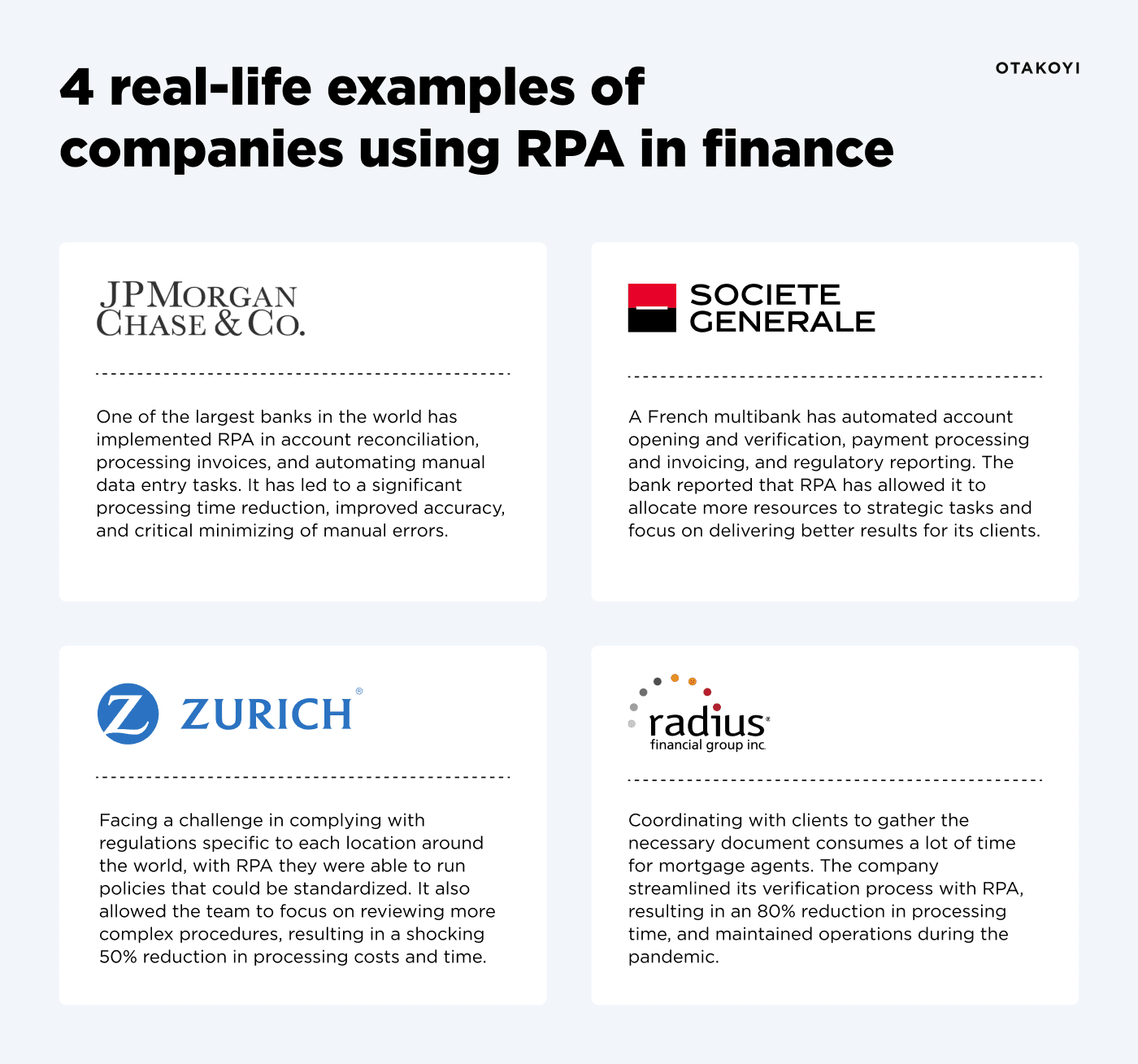

4 real-life examples of companies using RPA in finance

Are you still not convinced RPA is the must-have for your organization? Take your inspiration from success stories all over the globe. Here are four examples of companies that completely transformed their internal financial process.

-

JPMorgan Chase & Co. One of the largest banks in the world has implemented RPA in several major processes, such as account reconciliation, processing invoices, and automating manual data entry tasks. JPMorgan Chase’s RPA implementation has led to a significant processing time reduction, improved accuracy, and critical minimizing of manual errors.

-

Societe Generale. A French multibank has automated account opening and verification, payment processing and invoicing, and regulatory reporting. The bank reported that RPA has allowed it to allocate more resources to strategic tasks and focus on delivering better results for its clients.

-

Zurich Insurance. Due to their presence in various countries around the world, they faced a challenge in complying with regulations specific to each location. By incorporating RPA, they were able to distinguish between policies that could be standardized and processes automatically by robots, freeing up a substantial amount of time. RPA allowed the team to focus on reviewing more complex procedures, resulting in a shocking 50% reduction in processing costs and time.

-

Radius Financial Group. Coordinating with clients to gather the necessary document consumes a lot of time for mortgage agents. Any error made by either a bank employee or the client can lead to further delay. However, implemented RPA streamlines this time-consuming verification process, retrieving information from various data sources, resulting in an 80% reduction in processing time. By adopting RPA, Radius Financial Group was able to maintain its operations even during the drastic period of the global pandemic.

Optimize your auditing with RPA

The audit is vital for the credibility verification of financial records in any organization or institution. Optimized robotic process automation never misses any mistake or step in the accounting process, significantly reducing the risk of various compliance issues you might encounter in the future. RPA in corporate finance can interact with internal applications like EPR and CRM due to integrated AI and ML technology.

Introducing RPA in the audit process improves control and consistency, boosts data accessibility through integration with a variety of systems, and increases accuracy and efficiency.

Automate your workforce with OTAKOYI experts

OTAKOYI is a top expert in Fintech software development, serving organizations across the globe for many years. Our team has a unique take on how to optimize and empower the financial sector with ahead-of-curve digital solutions. Our software developers can build customized state-of-art RPA tools to revolutionize your finance team.

Our partners choose us to deliver RPA for our:

- Cost-effective solutions;

- Fast delivery time;

- Industry-standard development practices;

- Quality customized RPA tools;

- Integrations with existing systems.

Ready to rebuild your internal workforce? OTAKOYI has the tools you need, from applications and websites to unique software solutions!